- Private fund

- Financial

- Automobile financing

- Insurance

- Cryptocurrency and you can NFTs

- Exactly how house guarantee financing work with Texas

- Assess and compare Tx house guarantee loan otherwise HELOC interest rates

- How much ought i acquire that have a home guarantee financing?

- Exactly how HELOCs work in Texas

A house security financing makes you borrow secured on the value in your home. Really individuals explore house security fund to have higher instructions such as for instance home improvements, to find an alternate household, scientific bills otherwise expenses.

Just how household security loans operate in Texas

Household guarantee financing can be found in a lump sum payment while generate repaired monthly installments on loan’s lifetime. The word is going to be from four in order to thirty years, according to the loan amount.

Colorado did not enable it to be family equity fund up until 1997, and it has home collateral money regulations that don’t apply to other states. The us government set these set up to attenuate a great homeowner’s exposure off property foreclosure and manage customers.

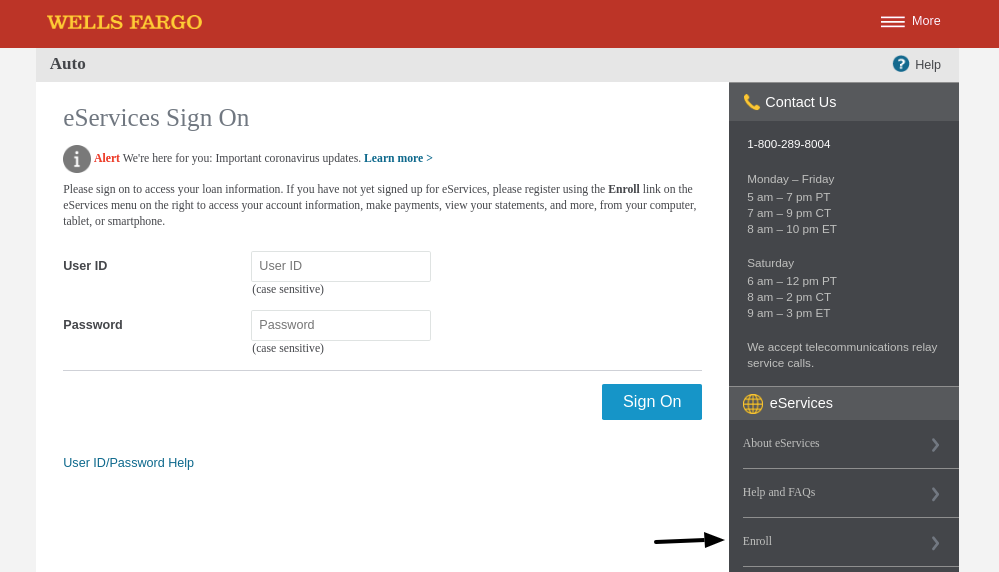

Calculate and you can examine Tx home guarantee financing otherwise HELOC interest levels

Fool around with all of our tool to acquire customized projected costs away from greatest loan providers based on your local area and monetary info. Find whether you are seeking a property Guarantee Financing or a beneficial HELOC.

See family equity mortgage or HELOC, go into your Area code, credit history and you may facts about your existing home to visit your personalized prices.

How much do i need to use with a home guarantee loan?

To calculate how much cash you can use that have a house security financing inside the Tx, you have to know a few trick one thing:

To get entitled to a house collateral financing, you want enough home guarantee – always at least 20%. Security ‘s the difference between your own house’s appraised worthy of plus an excellent balance into the home loan.

Like, state your home is cherished from the $150,000 while owe $100,000 on your https://paydayloansconnecticut.com/west-cornwall/ own financial, definition you have likely to $50,000 in home equity. You may be allowed to borrow around 80% of one’s house’s value.

Getting a beneficial $150,000 family, 80% try $120,000. Today we subtract your $100,000 mortgage harmony from the $120k, and our company is leftover on matter you could use in this example: $20,000.

How HELOCs are employed in Colorado

HELOCs into the Texas functions similarly to domestic equity finance. Tx laws requires that all the HELOCs provides an optimum financing-to-worth proportion of 80%, definition you could potentially use as much as 80% of your own house’s appraised worthy of. Tx rules as well as states that your household collateral credit line should have at least mark away from $4,000.

The benefit with HELOCs is you can mark money because the needed, doing the utmost amount borrowed. Most HELOCs have a draw months you to continues a decade, and you may a payment age to two decades.

Which have HELOCs you only pay focus towards amount you lent inside the draw period, and you may re-borrow the cash as required – like how you would fool around with a credit card.

How bucks-aside refinance loans are employed in Colorado

A cash-aside home mortgage refinance loan replaces your existing home loan with a new, larger loan, letting you sign up for cash in the form of collateral. In the Texas, an earnings-away re-finance is additionally named a part fifty(a)(6) mortgage.

Such as for example, when your house is well worth $100,000 and you also are obligated to pay $70,000 on the home loan, you have $31,000 home based collateral. If you got out a cash-out refinance loan to have $80,000, might located $10,000 inside bucks at the closing.

The way to get a knowledgeable rate for the Texas

Using these tips will help improve your chances of qualifying to own a lesser price into property collateral loan inside Colorado.

Solution money having Texans

If you don’t consider you’ll be eligible for a home guarantee loan within the Tx – or you simply should not exposure foreclosures – it is possible to evaluate these possibilities.