CMBS mortgage origination is the procedure in which a great conduit bank assesses a borrower’s commercial loan application, find their suitability to own financial support, gifts new terms towards borrower, and you may, if each party agree, things financing. Compared with bank loans, the newest CMBS origination process can be somewhat cutting-edge, once the for each and every financing have to see certain credit requirements so you can become securitized. In this procedure, good conduit money is pooled together with other financing and you will ended up selling so you’re able to investors because the industrial home loan backed ties.

- CMBS Origination: The basic principles

- CMBS Underwriting

- Legal Fees and you can CMBS Origination

- For additional info on CMBS finance, fill in the shape less than to dicuss in order to an effective conduit loan specialist today!

- Related Inquiries

- Score Capital

CMBS Origination: The fundamentals

CMBS mortgage origination is the procedure where a conduit financial assesses a great borrower’s industrial application for the loan, identifies their suitability to own investment, gifts new words towards the borrower, and you can, in the event that both parties concur, facts loans. Weighed against bank loans, the new CMBS origination procedure can be somewhat advanced, given that each financing need to satisfy particular credit requirements to help you getting securitized. Inside techniques, conduit loans is pooled along with other finance and ended up selling so you’re able to dealers once the commercial home loan recognized bonds

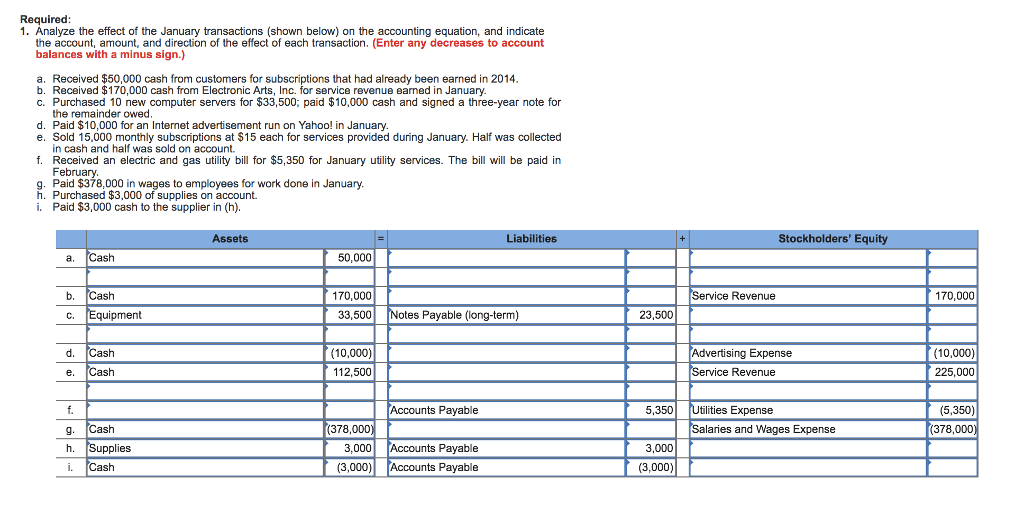

Generally, the quintessential time intensive part of CMBS origination is the underwriting process, that is designed to see whether a debtor gift ideas a good borrowing chance to a loan provider. A loan provider requires 3rd-group reports, such a complete assessment and you may Phase I Environment Analysis, and will check out an excellent borrower’s credit history, websites worthy of, and you may commercial a property sense. When you find yourself borrower borrowing from the bank, net value, and experience standards is decreased strict to possess conduit fund than just having financial or service loans (we.e. Fannie mae and you may Freddie Mac computer), which have good credit and several industrial a property control/management experience indeed support.

Judge Charges and you may CMBS Origination

Taking care of out of CMBS origination one borrowers should become aware of is that the conduit finance commonly wanted consumers to blow notably high lender court fees than simply whatever other type off industrial home mortgage. Like all industrial loans, consumers have to shell out the lender’s legal can cost you, but, because of the intricacies a part of securitization, CMBS lender court essentially can cost you $fifteen,000 having finance below $5 mil, with that count going up so you can $29,000 or even more to have big finance, and even surpassing $100,000 or more into largest conduit fund.

What are the tips involved in the CMBS loan origination processes?

Brand new CMBS mortgage origination procedure comes to multiple strategies. Basic, the financial institution usually familiarize yourself with brand new borrower’s application for the loan to see their suitability getting money. The lending company will present the terms of the borrowed funds so you’re able to the newest borrower and, if the both sides agree, issue the funds. The absolute most frustrating an element of the processes is the underwriting processes, which is designed to determine whether the newest debtor gift ideas a fair borrowing from the bank exposure to the financial loans in Candlewood Lake Club. The lending company requires 3rd-class profile, such as the full assessment and you will Stage We Ecological Review, and can check up on the brand new borrower’s credit rating, internet well worth, and industrial a house experience. After the mortgage is available into second industry, it is usually transformed in order to financing maintenance organization.

CMBS fund is advantageous to own commercial a property borrowers because the they won’t need much analysis of your own borrower. Rather, the mortgage is underwritten on the financial energy of your house kept once the security. CMBS loans are usually provided with repaired interest rates and also have regards to five in order to a decade, with amortization periods of up to thirty years. In addition, CMBS fund offer flexible underwriting assistance, fixed-rates financial support, and are totally assumable.