There is absolutely no perception like researching brand new secrets to their most own home. Given that whole process of purchasing a property can seem challenging, having veterans and you may servicemen and you can female, the fresh Agency out of Experts Products written some great financing alternatives. Such strong loans result in the processes more relaxing for whoever has worked hard in regards to our nation. Virtual assistant Home loans are rewarding financial available options exclusively for army players as well as their household. Among the first strategies is to find the Va mortgage pre-recognition. Just after you are acknowledged, you may then keep on your house buying trip and you will works your path to homeownership.

The essential difference between pre-certification and you may pre-acceptance

Sometimes you may also hear the term pre-qualify whenever undertaking your home to buy excursion. You will need to remember that if you’re an excellent pre-degree can be useful in the first stages of getting a home, it truly is distinct from having your pre-acceptance. An effective pre-certification makes reference to a quote having borrowing given by a lender considering recommendations provided with a debtor. These rates are a good idea, but a beneficial pre-approval is much more very important.

Pre-approvals is actually initial recommendations from possible borrowers of the a loan provider. Such determine the new to find power from a purchaser, basically determining what kind of cash the lending company are ready to give. To see an excellent pre-approval, the lender will need to manage a credit file to decide your credit score and you will loans-to-earnings ratio.

Step one in creating your pre-acceptance processes would be to contact a lender. While a military member otherwise experienced, it is vital to work at a loan provider just who understands the in and outs at work which have armed forces family members. That have a loan provider that is also a professional regarding Va Financial processes is going to be Mississippi payday loans a casino game changer.

Why pre-approvals are essential

Pre-approvals are very valuable which help you influence the cost variety you really can afford. There are some even more key reasons why he or she is essential including indicating so you’re able to sellers and their real estate professionals that you will be a beneficial severe visitors. Information the to invest in power is crucial before going house searching. This should help you narrow down your desires and requirements for the a home and enter the processes impression pretty sure. Their realtor may also make use of pre-acceptance so you’re able to restrict homes that are good for your.

When you find the domestic of your dreams and wish to generate an offer, pre-approvals can help get romantic quicker. Vendors try motivated to circulate their houses rapidly to customers just who have the ability to pick at the mutually decideded upon prices. That have a beneficial pre-recognition in hand after you create a deal, you might be demonstrating the seller as well as their realtor which you suggest company.

Once the to purchase a house is actually a primary resource, your bank will demand various data to truly get you pre-accepted. These are the method that you prove you’re able to shelter your home loan payments and certainly will be able to pick a house. Some lenders consult equivalent files, you should consult with your own to make sure you promote everything expected. It can be best if you continue such useful during the procedure. Samples of data you may need to offer include:

- An authorities-given ID

- Tax returns- extremely loan providers consult their two really-present state and federal production.

- Proof of income- you might oftentimes reveal this courtesy W2s and you can 1099’s.

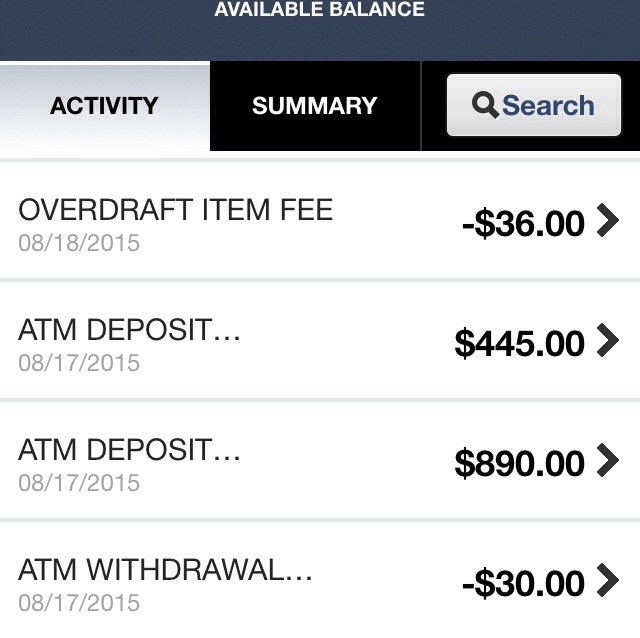

- Assets- this may involve bank comments and just about every other levels particularly a great 401K. Your bank allows you to understand how far back you prefer to go whenever indicating statements. They could in addition to demand upgraded comments since the home buying processes continues on.

- People loans you have- if you have an excellent loan instance an auto loan otherwise student loan, the lender will have to understand.

- Book costs- these could be important to show you have been and come up with constant repayments.

Additional documents start around divorce proceedings records, bankruptcy records, and current emails if the anybody try helping you build your down payment.

While you are a seasoned or armed forces member seeking take advantage of new Virtual assistant Mortgage, you really need to work at a great Va-acknowledged bank. So you’re able to submit an application for an excellent Va Loan, you will need to likewise have your Certification off Qualifications (COE). So it file shows that you will be permitted utilize this hard-received benefit. If not already have their (COE), loan providers just who concentrate on dealing with army players will help. Read here more resources for the entire process of getting their COE.

Let’s say you do not have an informed borrowing from the bank?

Credit ratings is actually quantity you to cover anything from 300-850 and you may portray your creditworthiness. That have a high score enables you to a more attractive debtor in order to a possible lender. They’re able to in addition to help you to get a much better interest rate. There are several important aspects that show up on your credit report and get into choosing how large your get are. These are typically the quantity of discover levels, full quantity of personal debt, how frequently their credit might have been focus on, plus.

People faith they can not get property if the the credit score try less than 640. Within MHS Financing, we offer brand new Broken Borrowing from the bank Financing so you’re able to army players and you can pros that helps individuals who could possibly get if not provides a hard time taking that loan. Because of these fund, we could render second odds, therefore empowering army members becoming homeowners.

When you’re willing to initiate your property buying trip towards Va Mortgage, we in the MHS Credit was here to greatly help. The benefits of new Va Financial are incredibly effective and you will try booked especially for armed forces users in addition to their family. Seasoned so you can seasoned, we should help you create solid, well-informed decisions. Call us today to get started on the brand new Virtual assistant Financing pre-recognition process.